Introduction

The government releases the flash estimates of the HDB resale and private residential price indices for the fourth quarter of 2021. Prices for all types of residential properties increased at a faster rate in 4Q 2021 compared to the preceding quarter.

Private residential property price trend

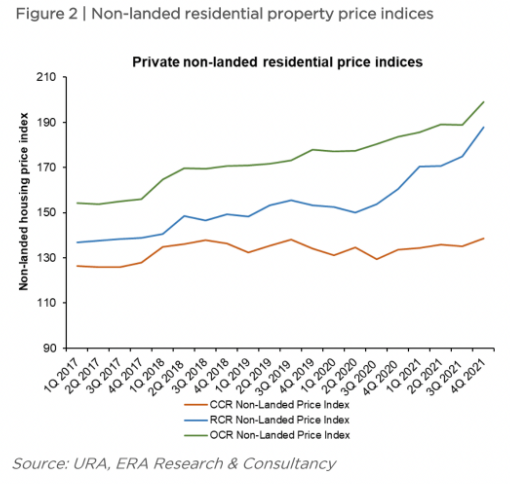

According to the flash estimates, the growth rate of the private residential property price indices across all the residential property segments accelerated in the last quarter of 2021.

The overall private residential property price index increased 5.0% quarter-on- quarter (qoq) in 4Q 2021 and 10.6% over 4Q 2020. Compared to the 1.1% qoq price grown in 3Q 2021, the growth of the real estate price index has surged strongly before the government implemented the latest round of cooling measures two weeks ago.

The 5.0% qoq price growth was the fastest rate of increase in the past 11 years. It would explain why the government imposed another round of property market cooling measures in mid-December 2021.

In the three market segments, the price index for Rest of Central Region (RCR) increased the fastest at 7.3% qoq, while the price index for CCR increased the slowest at 2.5% qoq in 4Q 2021.

The price index for landed housing grew 3.7% qoq in the fourth quarter, faster than the 2.6% increase in 3Q 2021.

Private property sales

The accelerated pace of price increase in the last quarter of 2021 occurred despite the slowdown in the sales transactions volume in the fourth quarter of last year. The number of private residential units transacted in the primary and secondary markets contracted 16.6% and 24.4% qoq respectively in 4Q 2021. As the government only introduced the recent cooling measures in the middle of December, the slower rate of property transactions in the fourth quarter already started before the latest property curbs took effect.

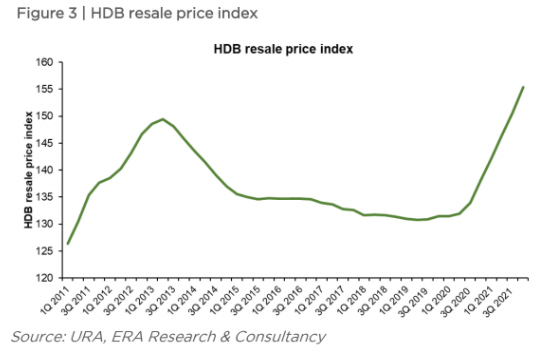

HDB resale price and future supply

The HDB resale price index also increased at a faster rate in 4Q 2021 at 3.2% qoq. Compared to a year ago, the overall prices of HDB resale flats increased 12.5% from a year ago.

HDB launched about 17,100 Build-to-Order (BTO) flats for sale in 2021. To address the strong demand and rising prices in the HDB resale market, the government plans to release up to 23,000 flats per year in 2022 and 2023. If necessary, the HDB stated that it is “prepared to launch up to 100,000 flats in total from 2021 to 2025, subject to prevailing demand”.

Next month, HDB will offer about 3,900 BTO flats in HDB estates such as Geylang, Kallang Whampoa, Tengah and Yishun. In May 2022, HDB will launch about 5,200 to 5,700 BTO flats in HDB towns such as Bukit Merah, Jurong West, Queenstown, Tampines, Toa Payoh and Yishun. Some of these flats could be offered under the Prime Location Public Housing (PLH) model.

Outlook

In the new year, there will be various factors that will pull the residential real estate prices in different directions.

Factors such as the expected economic recovery and the possible arrival of more foreigners to work, study and live in Singapore will have a positive impact on real estate prices and demand.

Real estate sales will primarily be driven by buyers who are less affected by the latest cooling measures, such as Singaporean and permanent residents buying their only residential property in Singapore. Therefore, the buying demand will be mainly from the owner-occupiers.

Other factors such as the tighter property market curbs, possible interest rate hikes and the ongoing pandemic could weigh down the property market. Among all these factors, the latest round of cooling measures is a major influence that would greatly increase the level of uncertainty in the local property market.

The silver lining is that although the Omicron variant of the coronavirus is more contagious than the earlier variants, it is not deadlier than the Delta variant, which was the previous dominant variant of this virus globally. This means that if no other deadlier variants of the virus were to emerge in the near future, the current pandemic may not have an even greater adverse impact on the real estate market than what had already occurred.

Considering all the factors, the private residential property price index could increase within the range of 0% to 3% year-on-year in the next 12 months.

As the latest round of cooling measures will have the least effect on the HDB resale market and they do not address the supply-chain problems in the construction of HDB BTO flats. The government’s response to the hot HDB resale market is to ramp up the supply of BTO flats in the next few years, rather than to curb demand. Curbing the demand for public housing will be highly unpopular with the people because for a large majority of Singaporeans, public housing is the only type of housing that they can afford.

In the short term, the prices of HDB resale flats could still increase within the range of 1.4% to 2.5% each quarter. However, if the shortage of manpower and materials in the construction industry gradually eases sometime this year, and the potential BTO applicants become more confident of getting the keys to their new flats within a more reasonable time of 3 to 4 years, the increase in the supply of new BTO flats will have a decelerating effect on the growth of the resale prices of HDB flats.

We will help you plan and find a property with financial prudency