After years of hard work, you have nearly reached the pinnacle of your career. But just as you start thinking about acquiring your next home or making that long-awaited ascent up the property ladder, reality hits! Home prices have risen substantially in recent years, and it feels like your dream of owning a home is further away.

After years of hard work, you have nearly reached the pinnacle of your career. But just as you start thinking about acquiring your next home or making that long-awaited ascent up the property ladder, reality hits! Home prices have risen substantially in recent years, and it feels like your dream of owning a home is further away.

And then it dawns on you: despite your high salary, juggling financial obligations and commitments has left you exhausted. You start to wonder if there are still ways for you to chase your property dream. In case you are curious, there is a specific term for it: High Earner Not Rich Yet, or simply, HENRY.

The term “HENRY” first appeared in a 2003 Fortune magazine article by Shawn Tully to describe individuals earning high incomes but feeling financially stretched due to high spending and financial commitments. HENRYs are those who are earning a comfortable income and are pursuing a swanky lifestyle, all while still finding themselves living paycheck to paycheck. Mind you, many of them hold respectable professions, from auditors, bankers, to lawyers, to name a few. Yet the majority of them continue to struggle to accumulate real wealth despite their relatively comfortable paycheck.

Who qualifies as a HENRY in Singapore?

Since there is no definitive income band, we will assume HENRYs to be individuals earning at least S$10,000 per month for discussion. In today’s context, that would place the individual’s earning capacity above the resident median household income of S$9,541 per month in 2024.

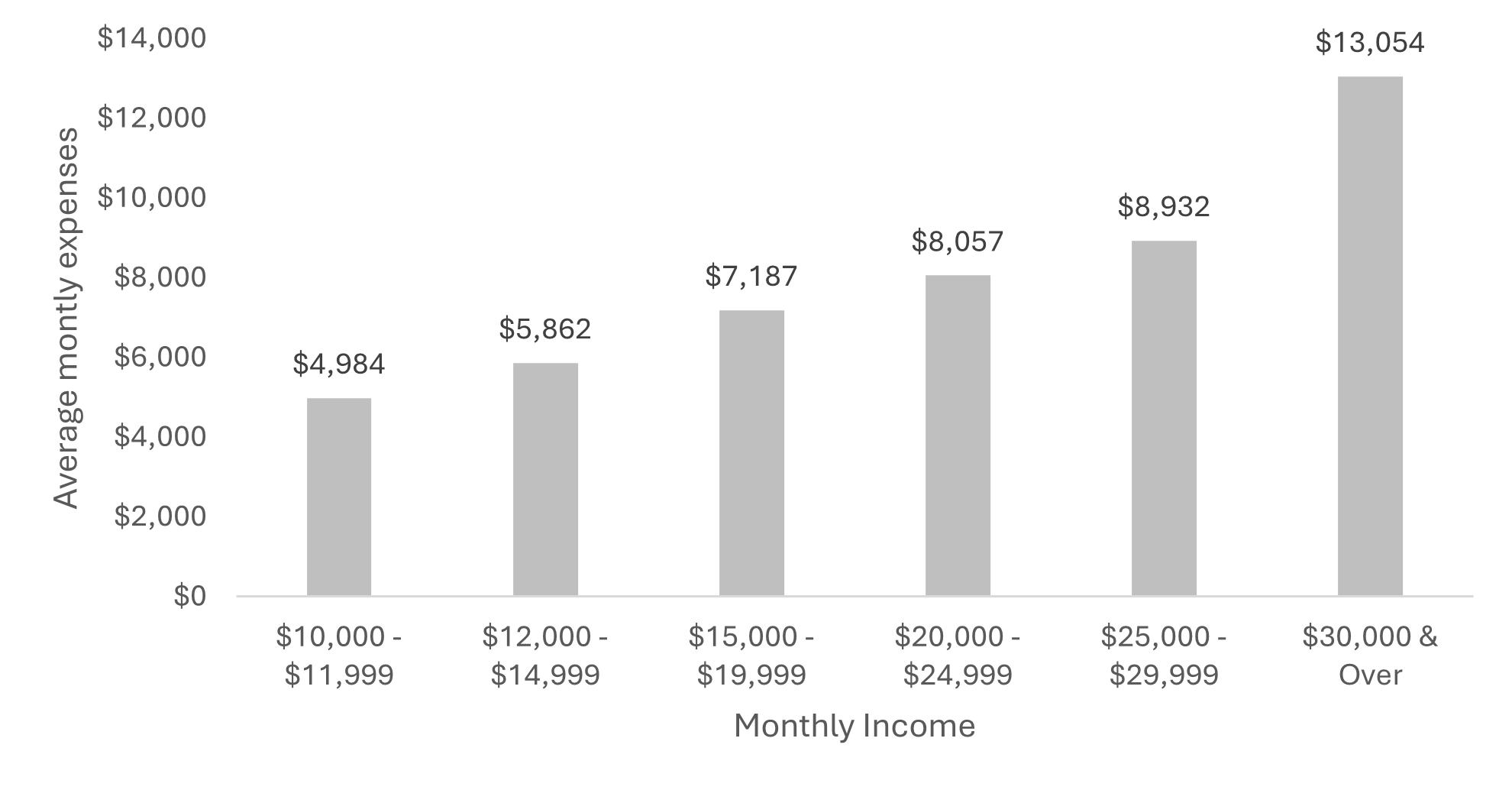

With high income comes higher expenses. According to Singstat, households earning between S$10,000 and S$12,000 reported an average monthly household expenditure of S$4,984 in 2025. This would put expenses at a comfortable 42% to 50% of their monthly income. However, this is not always the case for HENRYs, as their relentless pursuit of a high-quality lifestyle often means their expenses can be significantly higher than average.

Chart 1: Average Expenditure by Household Income Range in 2025

Source: Singstat, ERA Research and Market Intelligence

Dissecting what a HENRY Can Afford in Today’s Housing Market?

Let us take an objective view of what a HENRY can afford to buy today, based on their loan accessibility, current housing prices, and the cash or CPF outlay required.

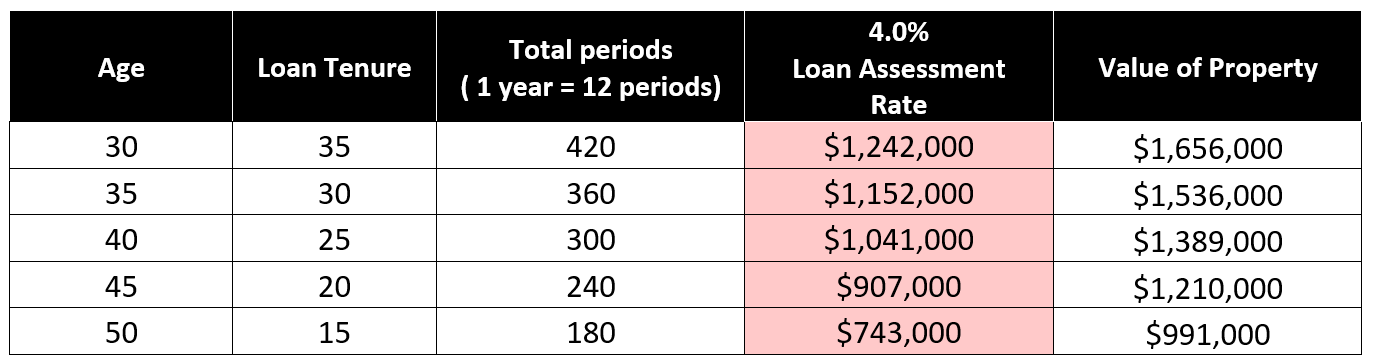

1. Loan Accessibility Based on Age

Age certainly advantages a younger HENRY! Under the Monetary Authority of Singapore’s (MAS) 4% loan assessment rate, a 30-year-old earning S$10,000 monthly would qualify for a maximum housing loan of approximately S$1.24 million, assuming a 35-year loan tenure. This enables them to purchase a home costing around S$1.65 million, based on a 75% loan-to-value (LTV) ratio.

Table 1: Loan Accessibility based on Age, based on S$10,000 Monthly Income

Source: ERA Research and Market Intelligence

Even for a HENRY in his 40s, he might be able to borrow up to S$1.0 million over a 25-year term, enabling him to buy a home costing around S$1.39 million. However, in most cases, a HENRY at this stage of life is likely already a homeowner, allowing them to upgrade to a larger or more centrally located property.

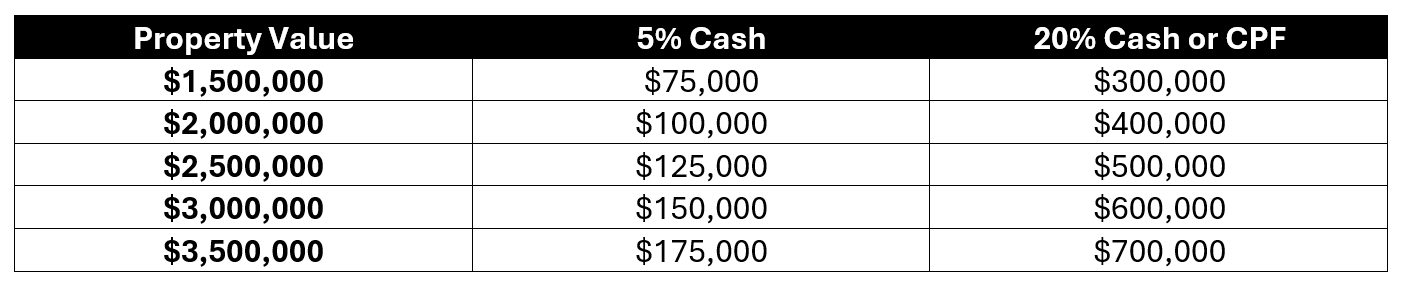

1. Cash and CPF component

Another important element in any home purchase is the capital outlay, which generally makes up at least 25% of the property’s value. In Singapore, banks require a minimum 5% cash outlay, with the remaining 20% of the down payment being possible to cover using cash or the Central Provident Fund (CPF).

Table 2: Minimal Capital Outlay based on Property Value

Source: ERA Research and Market Intelligence

For example, a S$1.5 million property provides an excellent entry point for young HENRYs, requiring a cash payment of around S$75,000 and approximately S$300,000 financed through a mix of cash and CPF savings.

Conversely, a property valued at $3.0 million would require a cash outlay of around S$150,000 and S$600,000, financed through a mix of cash and CPF savings.

In the first scenario, young HENRYs today are more financially savvy, and many could have saved a substantial amount of capital through prudent investing to fund their property deposit. Meanwhile, the second scenario would be suitable for an older HENRY who already owns a home that they can trade up from. But don’t forget, buyers should set aside enough funds to cover their stamp duties, as these can make up a substantial portion of the upfront payment.

1. What Can You Afford Based on Today’s Housing Price?

Next, we will analyse how housing prices have changed considering the surge of new home launches over the past two years.

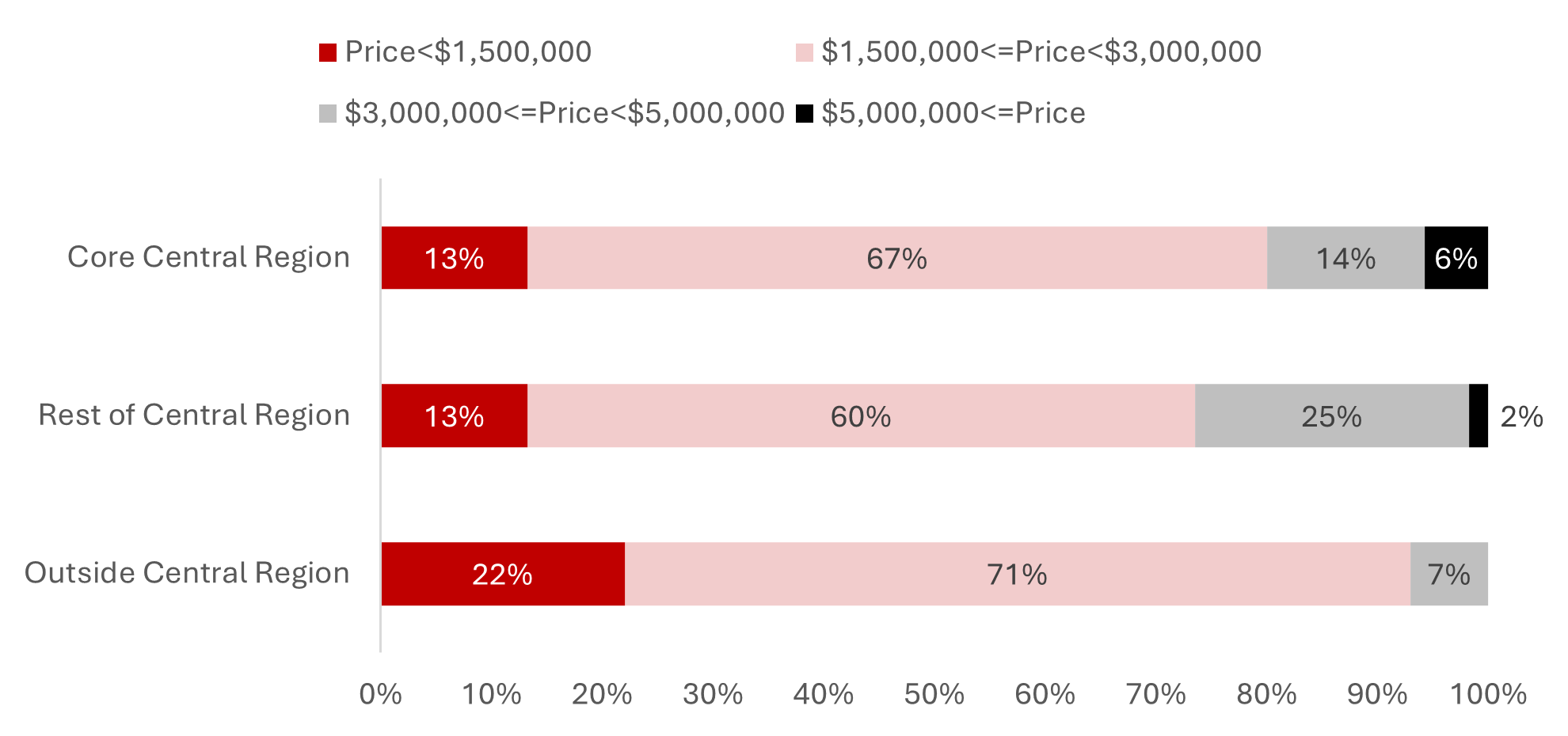

While home prices in the Rest of Central Region (RCR) and Outside Central Region (OCR) have experienced significant growth, supported by strong demand from local upgraders, prices in the Core Central Region (CCR) have remained relatively stagnant.

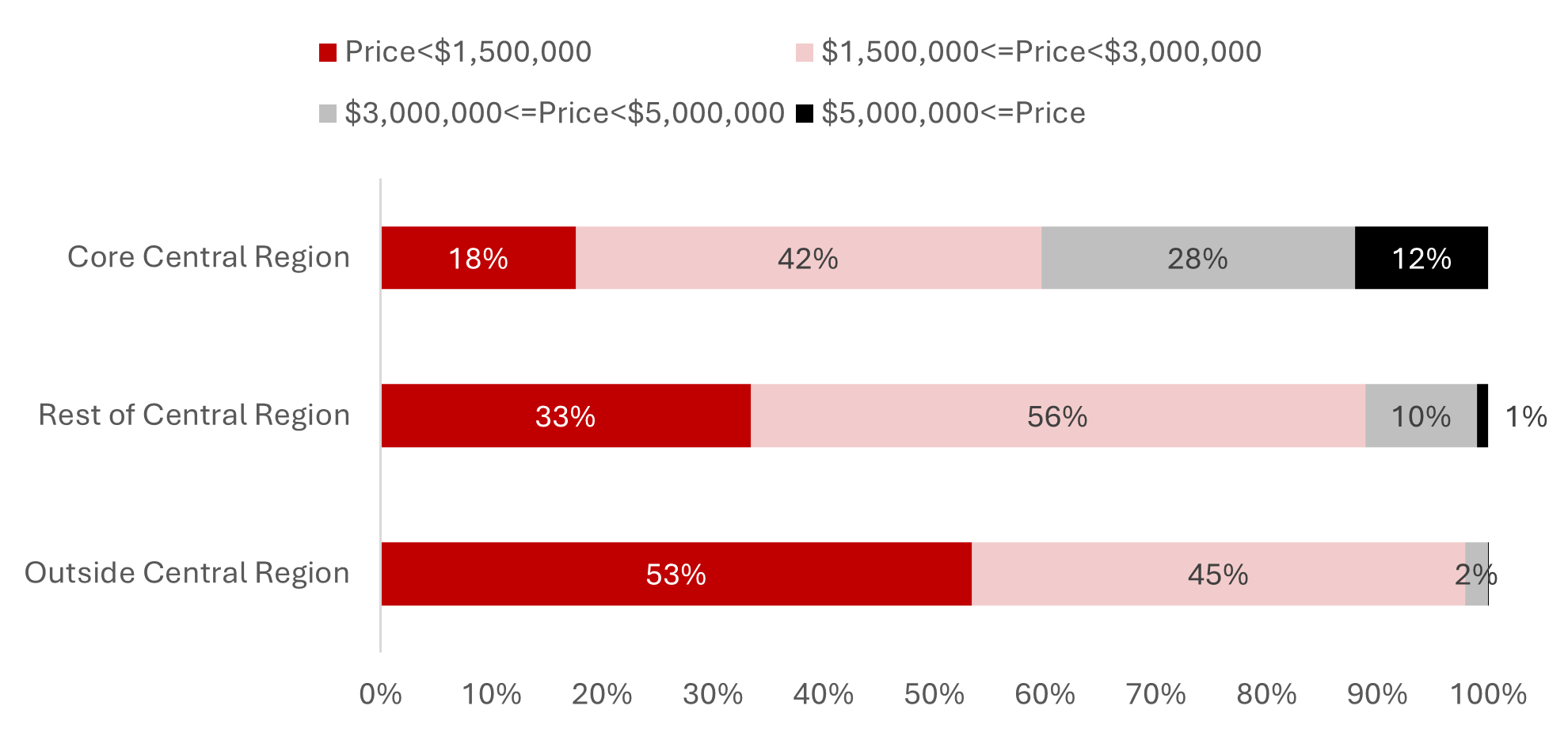

Chart 2: New non-landed homes transactions by price quantum (Jan-Sep 2025)

Source: URA, ERA Research and Market Intelligence

For HENRYs earning S$10,000 per month, 13% of RCR and CCR and another 22% of OCR new homes were sold at S$1.5 million, presenting an opportunistic price point for buyers seeking new homes at relatively accessible levels.

For buyers considering the resale or sub-sale market, the options expand further; many units are still available below the S$1.5 million mark, providing greater flexibility in location and move-in timelines.

Chart 3: Resale & Sub Sale non-landed homes transactions by price quantum (Jan-Sep 2025)

Source: URA, ERA Research and Market Intelligence

The New Sale or Resale Conundrum: What Best Fits Your Purpose?

Having understood what you can afford, now it’s time to consider the needs of your home.

For some, the appeal of a brand-new home lies in its modern facilities and the excitement of being the first to own a pristine space. New developments often feature the latest smart-home technology and well-designed communal facilities that cater to the lifestyle aspirations of younger buyers or those upgrading.

Another benefit of buying a new home is the progressive payment scheme, where payments are made in stages based on the project’s construction progress. This enables buyers to gradually increase their monthly instalments instead of committing to the entire loan repayment from the outset, easing cash flow during the building phase. However, the waiting period might be a deterrent for those seeking an immediate home.

Artist Impression of Zyon Grand

Conversely, resale properties enable you to move in almost immediately without any waiting period for construction. They also offer greater certainty because what you see is what you get. Furthermore, many resale homes tend to have larger layouts compared to new builds.

For those aiming to benefit from rental income, resale properties provide that advantage. Since these homes are move-in ready, owners can rent them out almost immediately and start earning rental returns.

Navigating the Property Dream On A $10,000 Income will Require Some Careful Planning, but it is Not Out Of Reach.

Navigating the property dream on a $10,000 income requires careful planning, but it is certainly not out of reach. With a clear understanding of your finances, realistic expectations, and the proper guidance, owning a home that fits your lifestyle and goals is achievable. What matters most is making informed decisions based on your life stage, risk appetite, and future aspirations.

Whether it’s a well-located resale flat or a thoughtfully chosen new launch, the key lies in aligning your purchase with your long-term priorities. Start by defining what truly matters, from space and location to investment goals, and let a trusted advisor guide you towards a home that grows with you.