In ERA Singapore’s 2025 My Dream Home Survey, we surveyed over 1,100 Singaporeans in order to uncover the unique challenges faced by Young Singaporeans in their pursuit of their Dream Home.

This is a part of a series based on findings from ERA Singapore’s 2025 My Dream Home Survey, in collaboration with Ngee Ann Polytechnic’s School of Design and Environment. The survey set out to uncover how Singaporeans’ housing aspirations are evolving amid changing market conditions and lifestyle priorities.

Young Singaporeans Find Homeownership Harder to Attain, but Actively Plan Ahead Despite Hurdles

In today’s day and age, many Young Singaporeans have grown increasingly financially savvy and look to build their wealth from an early age in their studies or career. This includes understanding the property progression journey, where 87% of Young Singaporeans agree with and have confidence in property as a reliable wealth-building tool. Although about 45% of young Singaporeans find it harder to invest in property nowadays, 56% plan to upgrade their homes in the future.

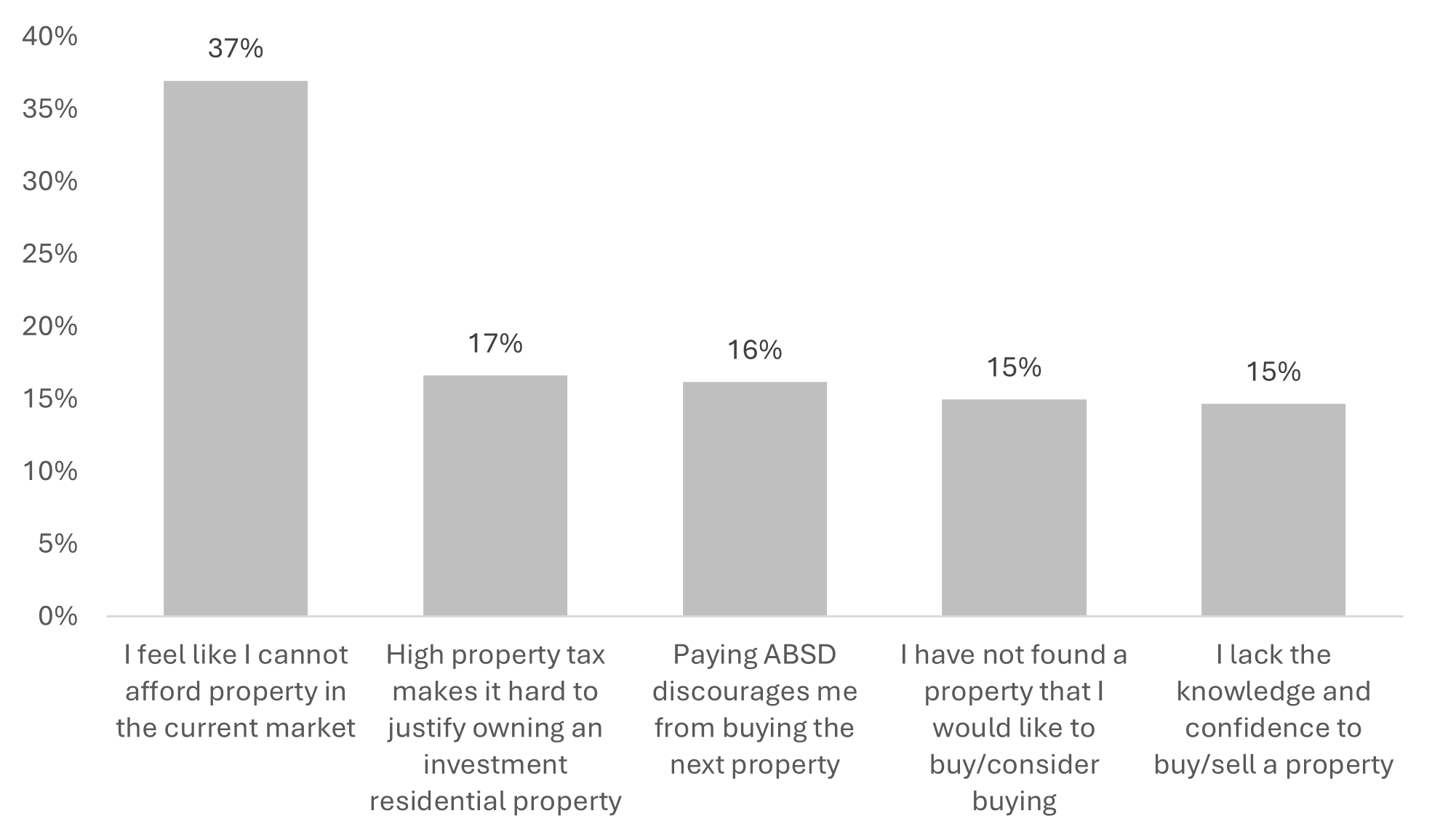

Affordability was a main concern expressed, with 37% of respondents stating that as their main challenge in buying a property in Singapore today. This is understandably the highest among all cohorts, as they are still studying or in early stages of their career and wealth accumulation. This finding helps explain why a larger share of Young Singaporeans (29%) expect to purchase a home only after five years, compared to 21% of all respondents, reflecting their current life stage and financial priorities.

Chart 1: Affordability is the most common challenge stated by Young Singaporeans who are looking to buy a property

Young Singaporeans Have Ambitious Property Ownership Perspectives but Remain Pragmatic

Our findings have shown that 15% of Young Singaporeans lack the knowledge and confidence to start in property investment, the highest amongst all surveyed cohorts. This reflects their inexperience in navigating the property market, as they are the group with the lowest number of homeowners.

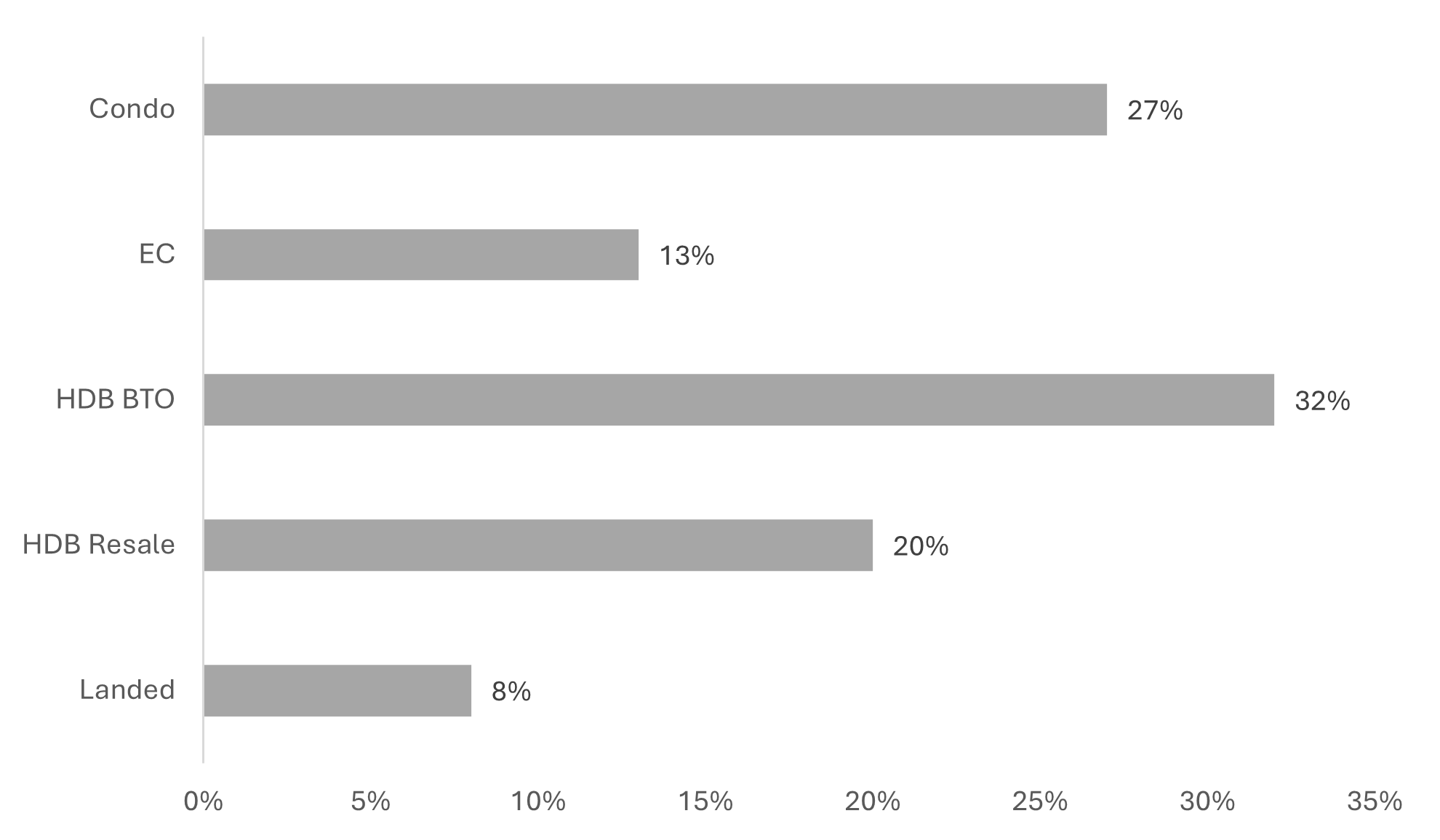

Only 17% of Gen Zs currently own a home, with a much higher 44% home ownership rate among Young Millennials. This scales up to 70% among Older Millennials, showing a clear path of ambition towards homeownership among Young Singaporeans, particularly as they progress in their career and savings. Among those looking to buy in the next three years, half of them are planning to buy an HDB flat, while 27% are looking to buy a condo.

Chart 2: About half of Young Singaporeans are looking to purchase a HDB flat in the next three years

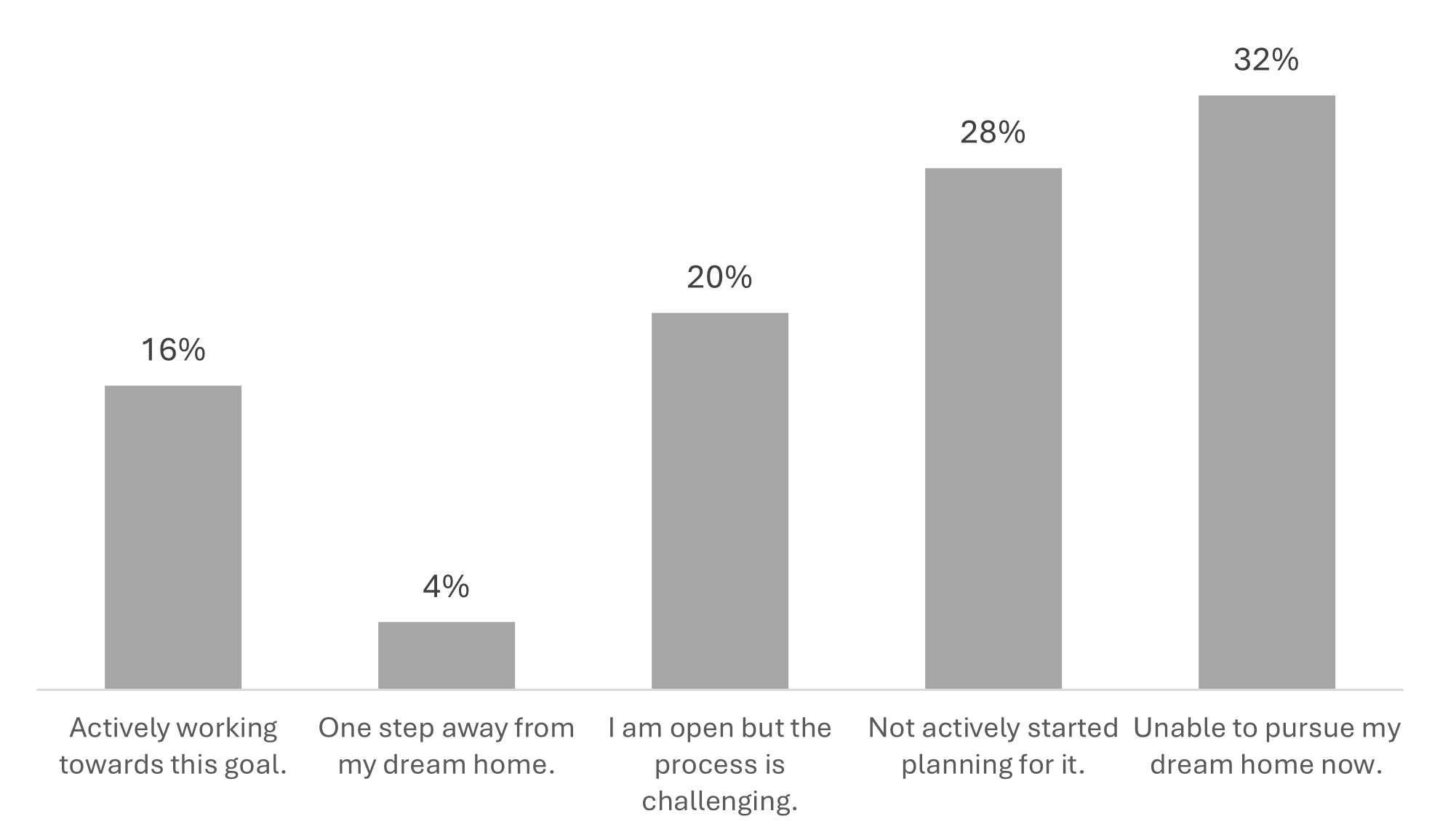

Regardless, one in five Young Singaporeans is actively preparing to start on their property journey. This includes saving aggressively to work towards their next home, and targeting homes under $1m, with 57% of respondents stating that as the likely price range of their next home. This price range consists mainly of resale and new (standard, plus, and prime) HDB flats, as well as smaller resale condominiums, which are popular among these cohorts of buyers.

Chart 3: One in Five Young Singaporeans describes themselves as “actively, or almost on the way to achieving their dream home”

Young Singaporeans Have a Long-Term View and Want to Buy Homes on Their Own Terms

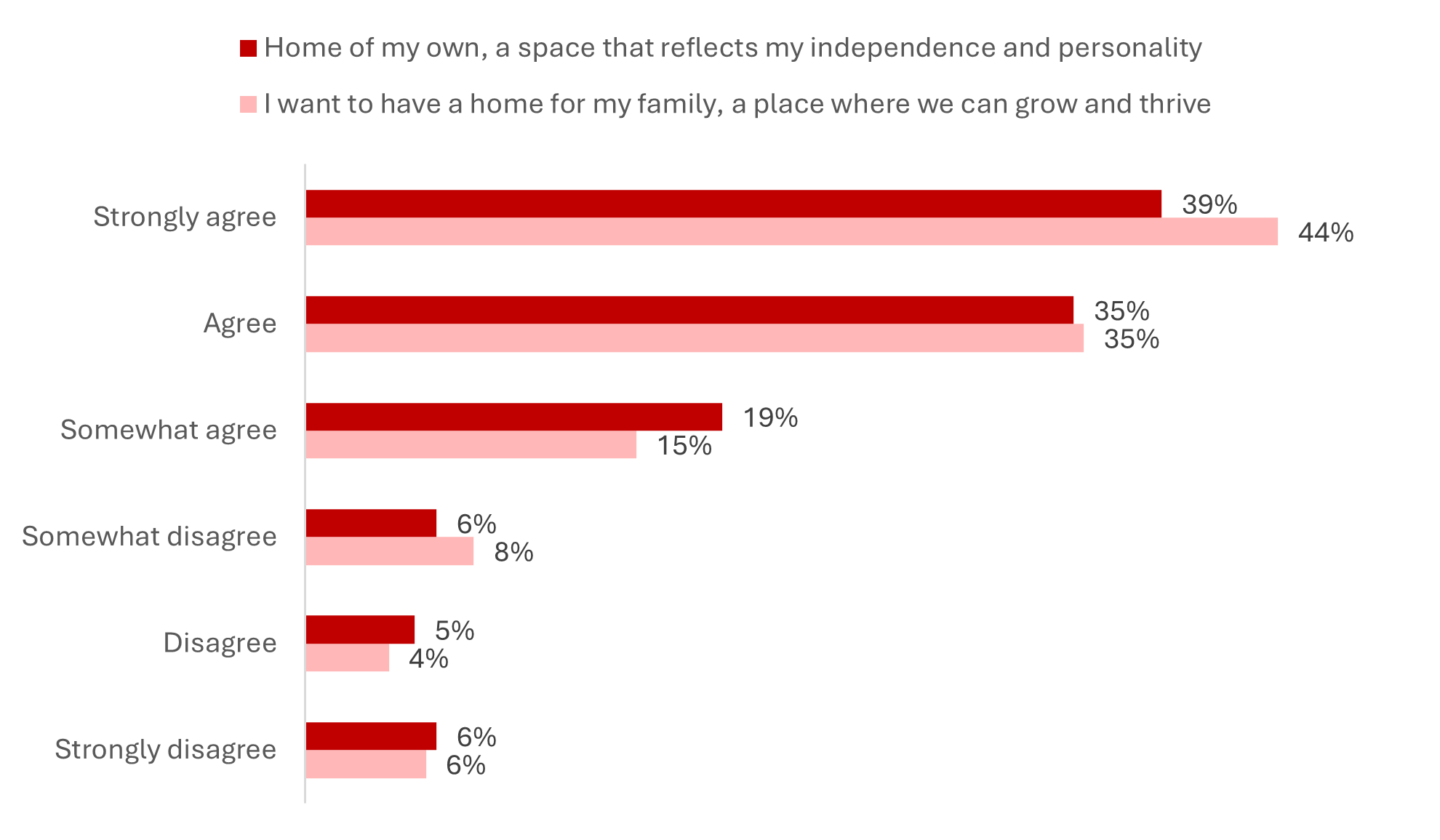

Unlike the Baby Boomers, who view homeownership as a way to meet societal expectations, Young Singaporeans are less bound by this mindset. Instead, the motivation to own a home is balanced with their personal aspirations, where 85.5% of Gen Zs expressed that they want a home to reflect their independence and personality, alongside family planning reasons.

Chart 4: Young Singaporeans express a strong desire to own a home – not only for family planning reasons, but also to have a space that reflects their independence and personality

70% of Young Singaporeans agreed that they preferred the idea of home ownership rather than renting in Singapore. This reflects the long-term view and ambition that Young Singaporeans have when it comes to buying a home, having witnessed future generations successfully use property ownership as a wealth vehicle.

At the same time, they have expressed an understanding that the path to property ownership is expected to stretch longer and might not be in a rush to meet traditional benchmarks (like buying by a certain age). Instead, they are pacing themselves to align with personal readiness and financial capability.

Lifestyle Ultimately Still a Priority for Young Singaporeans; Willingness to Upgrade for This Reason

Through our study, we have found that Gen Z’s preference for homes is rooted in their lifestyle needs. They tend to choose homes that balance pragmatism with their own lifestyle needs.

Young Singaporeans’ Need for Larger Living Spaces for Personal Use

When it comes to buying a home, Young Singaporeans place a stronger emphasis on larger floor plans, bigger bedrooms, and flexible layouts, allowing them to customise their space according to their social lifestyle.

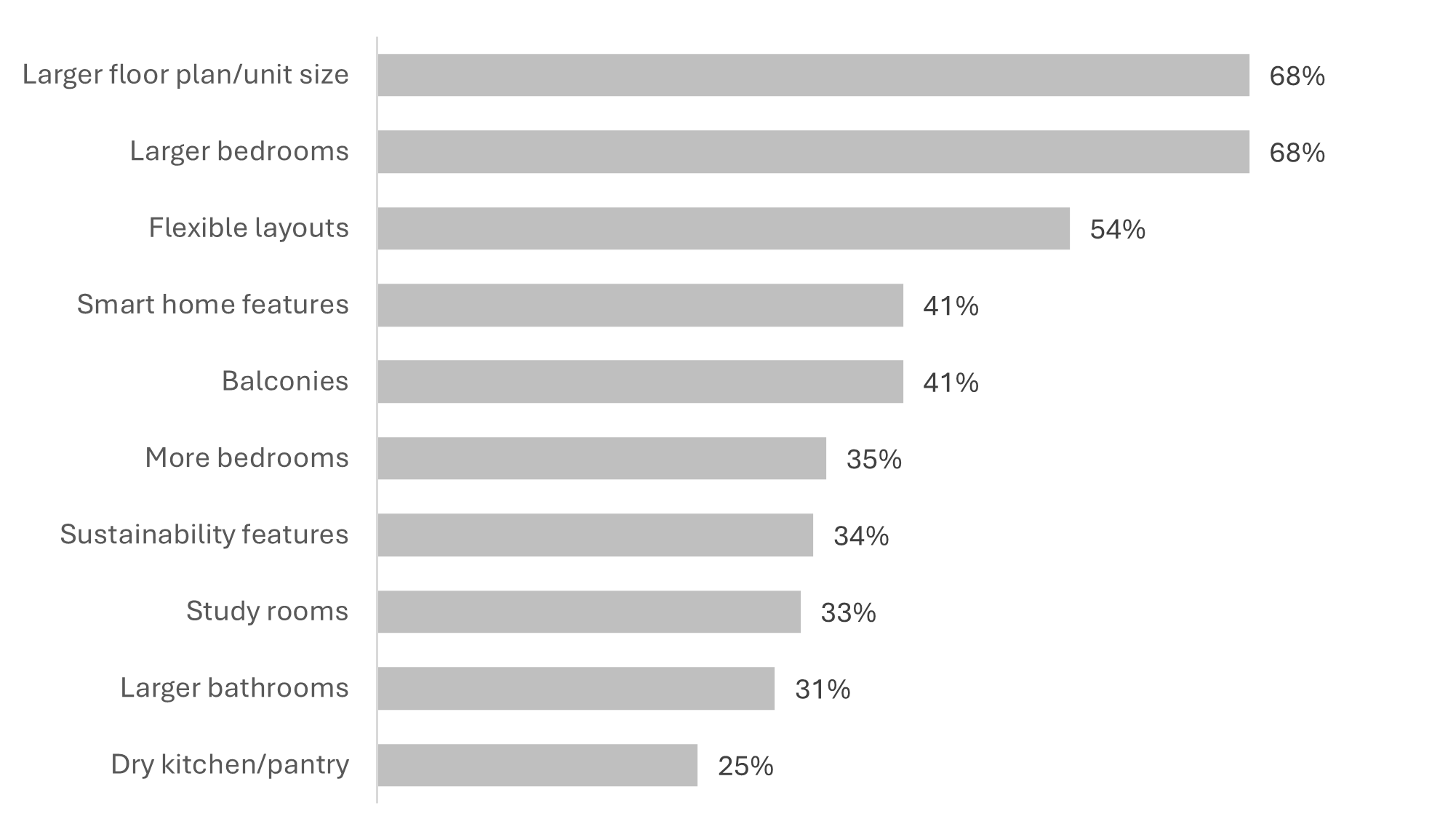

Chart 5: Larger unit sizes and bedroom sizes are sought after by Young Singaporeans – instead of more bedrooms, indicating a priority for larger spaces to suit their social lifestyles

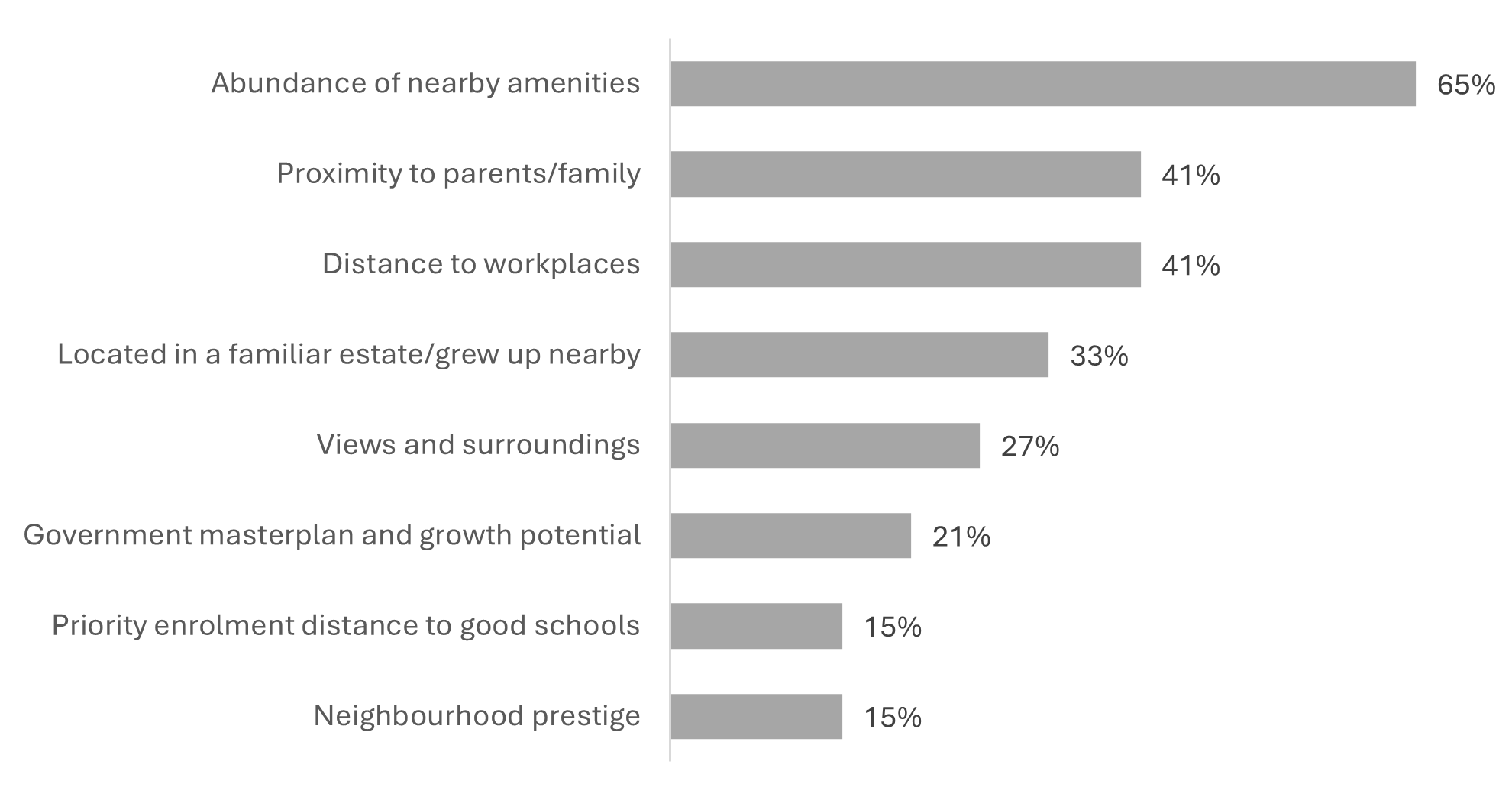

Young Singaporeans, such as Gen Zs and Young Millennials, place greater importance on finding a home surrounded by ample amenities and located close to their parents and workplaces. This aligns with their top housing priorities – proximity to public transport, shopping malls, supermarkets, and hawker centres, which offer both convenience and a vibrant lifestyle.

Chart 6: Young Singaporeans rank nearby amenities, proximity to family, and distance to workplaces as their top three locational attributes

These lifestyle priorities are more commonly associated with private housing and reflect that their aspirations are about quality of life, as much as investment.

Although they are the youngest group surveyed, Young Singaporeans remain highly aspirational with 56% expressing intent to upgrade their homes in the future, slightly higher than the overall average of 53%. This may reflect a strong intent to pursue private property as part of their future plans, especially as they begin to earn more and experience lifestyle inflation.

Conclusion

It is evident that Young Singaporeans, despite expressing the challenges and difficulties around buying a property, remain hopeful and eager to start on their own journeys of home ownership.

There is an acceptance that this journey might start at a later point in their lives compared to that of previous generations and older surveyed cohorts. This is due to the perceived higher barrier to entry for property prices, as well as an emphasis of pursuing an ideal lifestyle.

However, this does not mean that they are sitting around and waiting. Young Singaporeans have concrete plans to own homes in the future, as a foundation to start their families, and as a wealth-building tool. It just so happens that they are at ease with the fact that it might, and will take more time –a reality that they are ready to accept.