In ERA Singapore’s 2025 My Dream Home Survey, we surveyed over 1,100 Singaporeans in order to uncover the unique challenges faced by Young Singaporeans in their pursuit of their Dream Home.

This is a part of a series based on findings from ERA Singapore’s 2025 My Dream Home Survey, in collaboration with Ngee Ann Polytechnic’s School of Design and Environment. The survey set out to uncover how Singaporeans’ housing aspirations are evolving amid changing market conditions and lifestyle priorities.

Background

Comprising 394 respondents, millennials (aged 28-43) make up 33% of our survey respondents.

Millennials are at a pivotal stage in life, navigating multiple milestones as they enter and move through their 30s – including marriage, career progression, and purchasing their first or next home.

Given that this cohort spans the prime working years of most Singaporeans, Millennials have a wide income range – depending on their age, experience/seniority, and field of work. Notably, 23% of this cohort earns a monthly household income of under $6,000, balanced by mid-level earners between $6,000 to $12,000 (40%), and high earners (13%) with an income over $20,000.

Home Ownership

In contrast to their younger Gen Z counterparts, Millennials hold a much higher home ownership rate, at 62%. Most millennials have also started their own families, with 4-person households being the most common (30%), followed by 2-person and 3-person households (22% and 20% respectively).

At this stage, Millennials will often find themselves at a crossroads, where they might need to upgrade from their existing property (most often their matrimonial home i.e. a BTO flat) to better accommodate the size of their new family nucleus, as well as changes to their respective lifestyles (distance to work, schools, and other family-friendly amenities). Therefore, millennials have a much more pragmatic view when it comes to homebuying, and often a shorter and more actionable horizon than younger cohorts.

While satisfied with their current housing situations, a third of millennials feel the need to upgrade

Within the total survey cohort of millennials, a large majority (70%) reported satisfaction with their present housing arrangements.

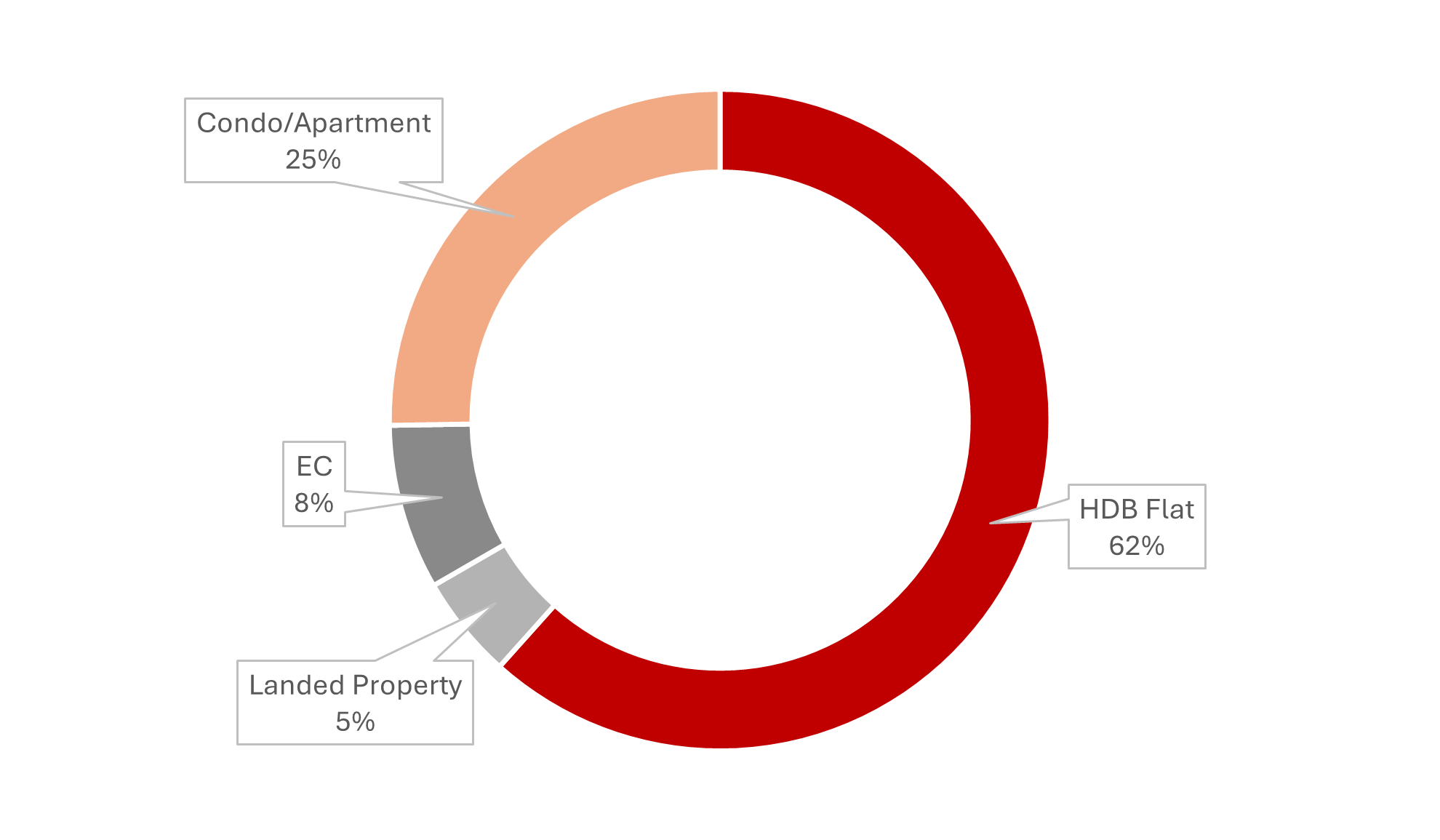

Chart 1: Current housing of surveyed Millennials

The majority of surveyed millennials reside in HDB flats (62%), followed by a quarter of respondents who stay in non-landed private homes (25%).

A third of millennial respondents expressed their interest in buying a new home within the short to medium term (under 3 years), with new private homes being their preferred choice (20%), followed by resale condos (16%), and resale HDB flats (16%).

Millennials’ choice of homes are largely determined by the budget they have at their disposal. Homes in the $500k to $1m price range are the most popular (38%) typically comprising of larger HDB units such as 5-room flats. This is followed by the $1m to $2m range (29%), which would enable many to upgrade to private properties.

Compared to the younger Gen Z cohort, millennials are able to afford higher-priced homes, leveraging sales proceeds from their existing properties, as well as greater cash savings and CPF balances accumulated over the course of their careers.

Millennials are aware of the asset progression journey, but have affordability concerns

Among all millennials surveyed, 41.9% have expressed that while they are not actively looking to buy or sell a home, they are open to the idea of selling their current home and upgrading if the right offer comes by.

Millennials demonstrate a strong belief in property as an investment asset, with around 82% agreeing that property is a reliable long-term investment. Such perceptions likely stem from them having witnessed the older generations profiting from property ownership. This is further exemplified by 80% of millennials agreeing with the view that property is a steady wealth-building vehicle over the long term.

However, despite this optimism, over half (56%) of Millennials have expressed that they felt that it is harder to invest in property today, especially at a younger age. The primary challenge stated is affordability, where 25% of millennials have expressed that they are unable to afford a new property in the current market.

Overall, Millennials perceive private housing as increasingly out of reach, with only 10% and 13.5% respectively agreeing that new and resale private condominiums are affordable.

Millennial condo seekers display a strong preference for city fringe, while HDB buyers look for affordable options in satellite towns

Among the pool of millennial respondents seeking to purchase a condo, there is a clear preference for city fringe locations. The top three choices indicated were East City Fringe (21%), North-East City Fringe (17%), and East (14%).

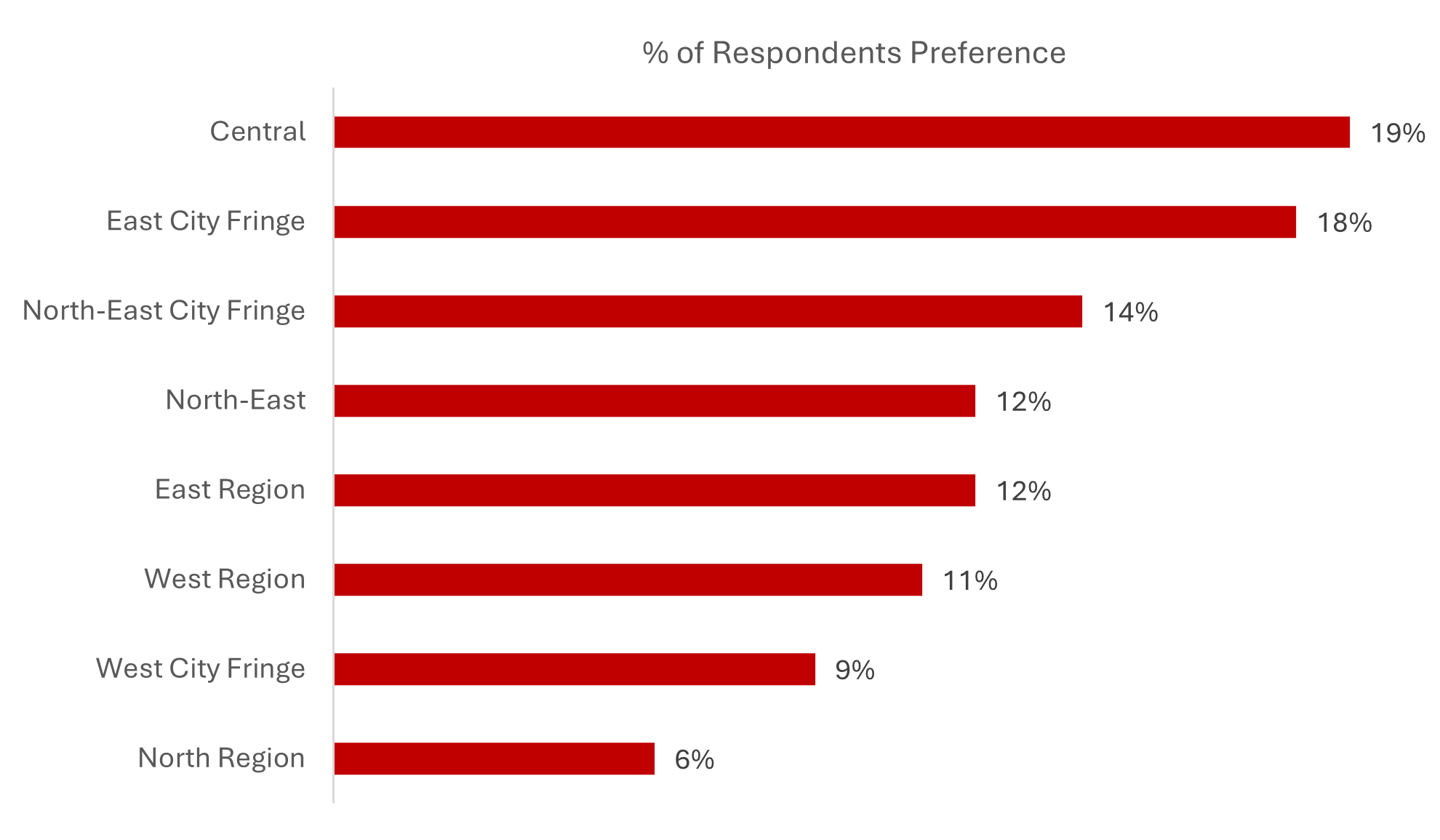

Chart 2: Condo-Seeking Millennials Locational Preference

In particular, the North Region stands out as the least desired location among millennial condo seekers, with only approximately 6% of the cohort picking it as their top choice.

This reflects a strong preference to stay in regions or towns that have strong location attributes. Homes in the East and North-East city fringes feature expressway connectivity to the city while offering a tranquil lifestyle and access to amenities.

The top location attribute that millennials prioritise are amenities within walking distance (66%), with public transport (79%), supermarkets (60%), and shopping malls (63%) emerging as the most popular choices.

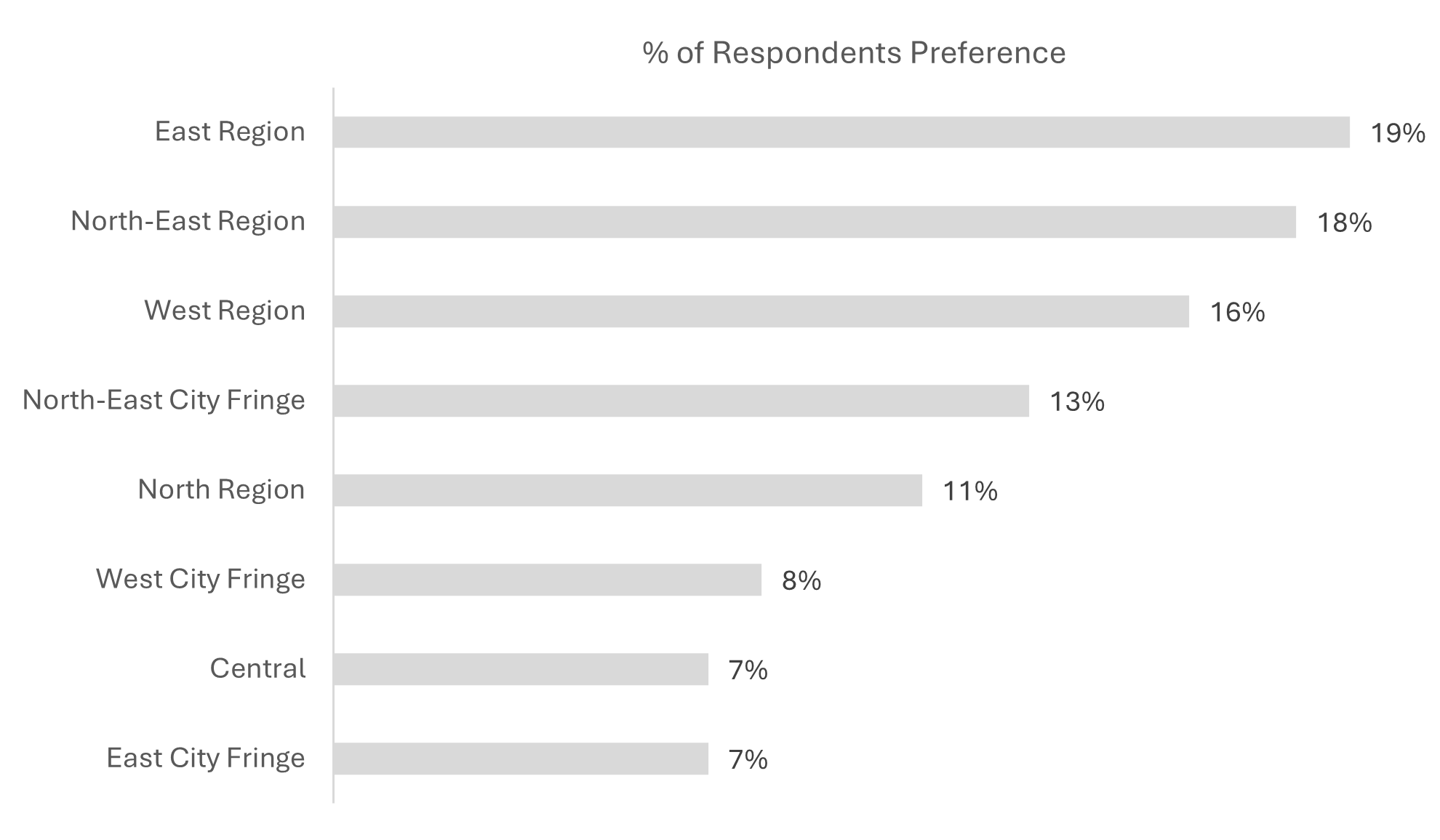

Chart 3: Resale HDB-Seeking Millennials Locational Preference

In contrast, millennials planning to purchase resale HDB flats displayed a more balanced spread of preferences, with the top three regions being the East (19%), North-East (18%), and West (16%). These regions consist of Singapore’s satellite towns, which feature more affordable property prices balanced with access to amenities. City fringe locations are less favoured by HDB-buying millennials, reflecting priorities driven by affordability and accessibility.

Conclusion

From our study, we can see that Millennials still have their eyes set on progressing through their property journeys – even with the many milestones, hurdles and challenges faced during pivotal years of their lives.

At the same time, there is an acceptance that this journey of progression might have a longer horizon as compared to the older Gen X and Boomer cohorts, who are more likely to have reaped benefits from the property market previously. With other major responsibilities in life that they have to consider, such as starting a family and caring for older family members, millennials hold a measured ambition for upgrading, balanced by genuine concerns of affordability in private homes.