In ERA Singapore’s 2025 My Dream Home Survey, we surveyed over 1,100 Singaporeans in order to uncover the unique challenges faced by Gen X Singaporeans in their pursuit of their Dream Home.

This is a part of a series based on findings from ERA Singapore’s 2025 My Dream Home Survey, in collaboration with Ngee Ann Polytechnic’s School of Design and Environment. The survey set out to uncover how Singaporeans’ housing aspirations are evolving amid changing market conditions and lifestyle priorities.

Background

In our survey of over 1,100 Singaporeans, a total of 389 (32.5%) respondents belonged to the Gen X social cohort, aged between 45 and 60 years.

Gen Xers are near the peak or plateau of their careers, having been in the workforce for two decades or longer. Therefore, it can be said Gen Xers’ earning power is also at its peak. However, they too often find themselves facing significant financial responsibilities, especially with children and aging parents under their care. Often, they find themselves facing a balancing act of juggling mortgages, school fees, and healthcare bills for their loved ones.

As a result, Gen Xers are actively focused on building assets or protecting wealth – be it paying off property, scaling back on debt and/or preparing to right-size after retirement. Compared to younger cohorts, this makes Gen Xers more conservative investors and property buyers.

Gen Xers Take a Pragmatic Approach in Choosing Their Next Dream Home to support their eventual retirement

Many Gen Xers have reaped the fruits of their early entry into the real estate market, with some 86% owning their current home, and have benefited from their property’s steady capital appreciation.

As a result, two thirds of Gen Xers view real estate as an investment vehicle for long-term wealth building in Singapore.

Gen Xers show distinct motivations in their housing aspirations compared to their younger counterparts, taking a more measured and pragmatic approach toward their next home. Many view property ownership not merely as a lifestyle choice, but as a financial strategy for to support their lifestyle and unlock funds for their eventual retirement days.

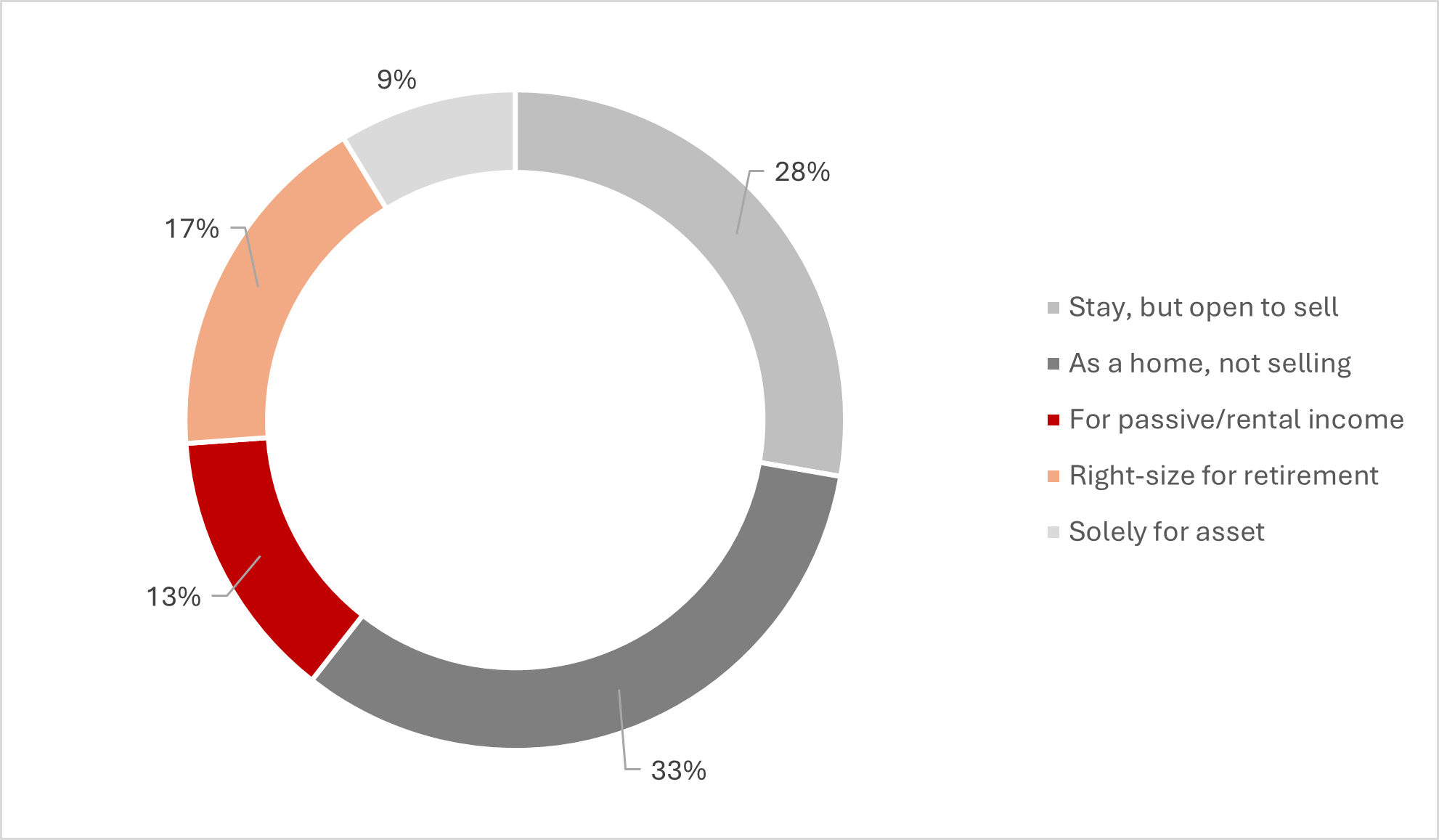

Chart 1: Gen X Purpose for their Home

About 13% are looking for a property that can serve as an income-generating asset, while a larger share (17%) plan to right-size their homes to free up capital for retirement or reinvestment.

Meanwhile, 28% plan to remain in their next property for the foreseeable future, though they remain open to selling if the right opportunity arises. One-third (33%) of Gen Xers are focused on finding a home that best fits their family’s long-term needs and intend to stay there indefinitely.

Gen Xers more likely to fund their next home using proceeds from the sale of their existing home and express stronger interest for resale homes

Among Gen Xers looking to buy a home, 45% plan to do so within the next three years. They also show a stronger preference for resale homes – with 21% indicating interest in resale condominiums and another 21% looking to purchase HDB resale flats.

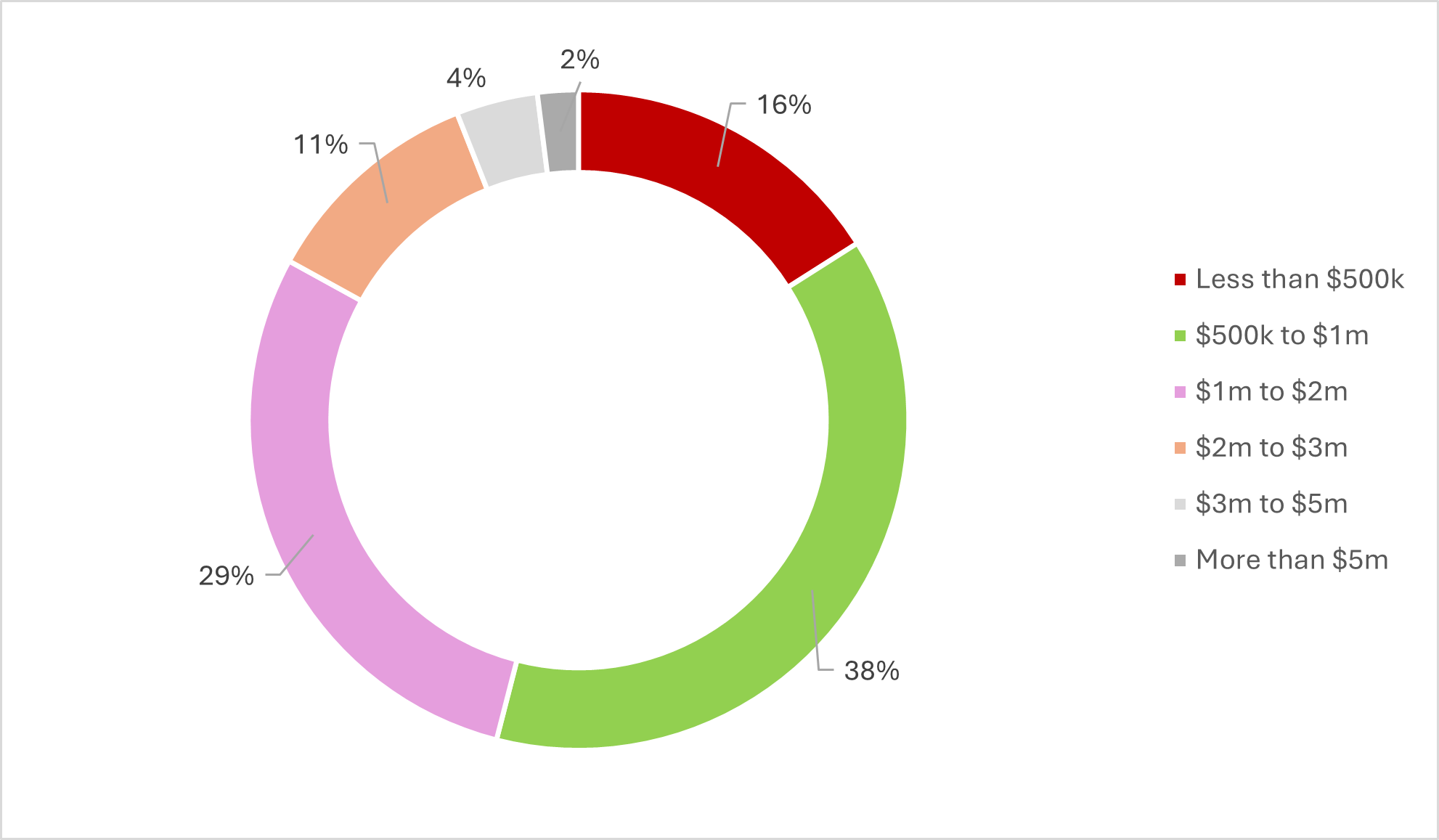

Chart 1: Gen Xers budget for their next home

Among the Gen Xers looking buy a condo in the next three years, 63% indicted they have a preferred budget of $1 to $2M for their future private condo home compared to 54% in 2024. Similar to last year (18%), 20% of Gen Xers are comfortable with a budget range of $2M to $3M (18%).

The rise in buyers with a $1 million to $2 million budget aligns with Gen Xers’ stronger inclination towards resale homes, which typically offer larger living spaces and are located in familiar neighbourhoods at relatively more attainable price points.

Unlike their younger counterparts, Gen Xers are more likely to fund their next home purchase through the sale of their existing property. About 70% plan to use proceeds from the sale of their current home, while 61% intend to draw from their cash savings. Meanwhile, 57% indicated that they are likely to take up a mortgage loan to finance their next purchase.

Millennials and Gen Xers are motivated to purchase private homes, but for very different reasons

Among the generational cohorts surveyed, millennials and Gen Xers are the most likely to purchase a private condo as their future home, with 35% and 37% of their total respective cohorts expressing interest in private homeownership. Consequently, the primary pool of demand for private homes over the short to mid-term is expected to come from buyers within these two demographics.

By and large, Millennials’ property purchases are driven by housing requirements, while Gen Xers on the other hand are strongly motivated by the promise of returns on their investments.

Both demographic groups also demonstrated similar preferences for their future private homes, with affordability, accessibility to public transportation, and property size being the top three features for consideration.

Likewise, gyms and functions rooms topped the list of desired facilities for both millennials and Gen Xers, along with regarded large communal areas and spacious bedrooms being their most desired unit features.

Conclusion

From our study, we can see that Gen Xers hold aspirations to make the final step to upgrade to a private property as they relish the final prime earning years of their careers.

Despite this, they practice pragmatism. Pressures that they may face as a result of being the sandwich generation makes it such that they have to take a more financially sound and more risk adverse approach as compared to the younger cohorts. When it comes to purchasing homes or new properties, they have a more conservative perspective, looking to guarantee value that they can carry over into their retirement.