Introduction

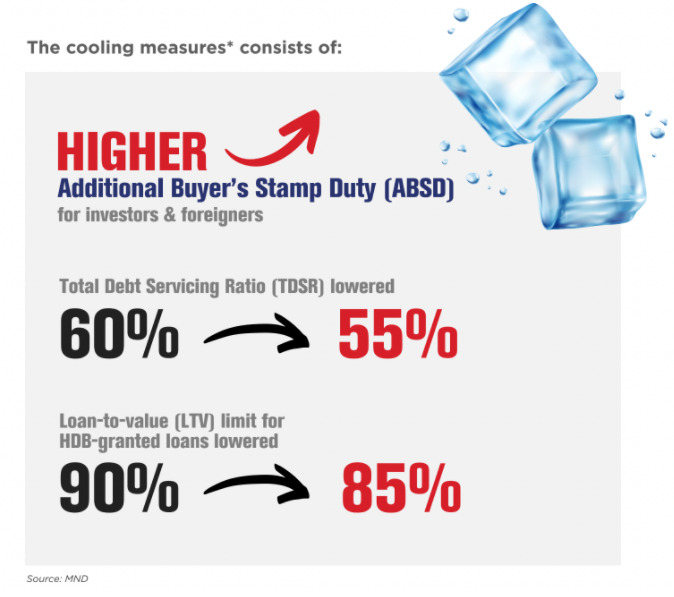

The Singapore government announced a new round of property market cooling measures which took effect on 16 December 2021

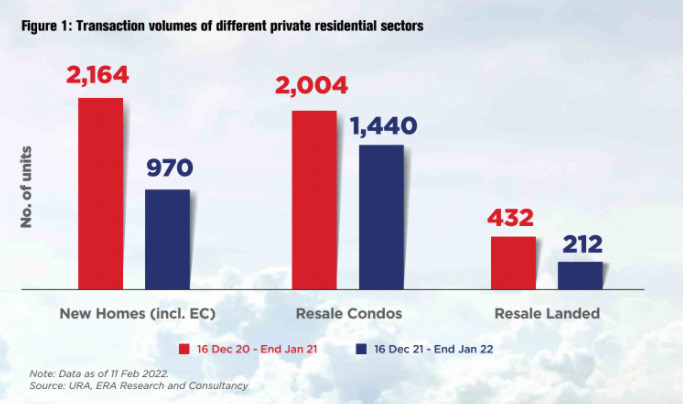

This report will examine the short-term impact of the latest cooling measures by comparing the 1.5-month period after the announcement on 15 December 2021 with the 1.5-month period one year earlier.

Private Homes New Sales Volume

In the 1.5-month period after the announcement, the number of private residential units including Executive Condo (EC) sold by developers decreased 55% year-on-year (yoy) to 970 units.

The decline is partly due to the low number of major new residential projects launched in December 2021 and January 2022 compared to the same period one year earlier.

The major projects launched in December 2020 and January 2021 were as follow:

Table 1: Major residential projects launched in December 2020 and January 2021

| Project Name | Location | Planning Area | Total No. Of Units | Median Price ($ psf) |

| Clavon | Clementi Ave 1 | Clementi | 640 | $1,636 |

| Ki Residences at Brookvale | Brookvale Drive | Clementi | 660 | $1,765 |

| Normanton Park | Normanton Park | Queenstown | 1,862 | $1,762 |

| The Reef at King’s Dock | Harbourfront Ave | Bukit Merah | 429 | $2,277 |

| Parc Central Residences (EC) | Tampines St 86 | Tampines | 700 | $1,177 |

Source: ERA Research & Consultancy, URA

The major projects launched in December 2021 and January 2022 were as follow:

Table 2: Residential projects launched in December 2021 and January 2022

| Project Name | Location | Planning Area | Total No. Of Units | Median Price ($ psf) |

| Mori | Guillermard Rd | Geylang | 137 | $1,886 |

| Perfect Ten | Bukit Timah Rd | Tanglin | 230 | $3,207 |

| Zyanya | Lorong 25A Geylang | Geylang | 34 | $1,898 |

| Belgravia Ace | Belgravia Drive | Serangoon | 107 | $1,080 |

Source: ERA Research & Consultancy, URA

Condo Resale Volume

The number of resale condo units sold in the 1.5-month period ending 31 January 2022 decreased by a smaller percentage of 28% yoy, compared to the rate of decline of the primary market sales volume and the number of resale landed houses sold over the same period.

The HDB resale market is still healthy and less affected by the cooling measures. Many HDB upgraders will buy resale condominiums because they need completed housing units as their homes. Therefore, the demand from HDB upgraders was supporting the private condominium resale market.

Landed Housing Resale Volume

In the 1.5-month period after 15 December 2021, the number of private resale landed residential units sold decreased 51% yoy to 212 units.

This is partly because the prices of landed residential properties has increased 13.3% yoy in 2021, faster than condominium prices. The buyers were more cautious due to the latest cooling measures.

Second, there could be a mismatch in expectations between buyers and sellers. Many sellers are unwilling to lower their asking prices as there is a limited stock of landed houses for sale.

HDB Resale Volume

The latest cooling measures had little impact on the HDB resale transactions in the weeks after it was implemented. In the 1.5 months after the introduction of the property curbs, the HDB resale volume slipped by only 2% compared to the corresponding 1.5-month period one year earlier.

One of the cooling measures announced on 15 December 2021 was the lowering of the Loan-to-Value (LTV) ratio from 90% to 85% for HDB housing loan granted by the HDB. This will have limited effect on the demand for resale HDB flats.

First, many buyers of HDB flats would not borrow from the HDB because the private banks offer lower interest rates for the mortgages.

Furthermore, homebuyers will have to use most of the money in their CPF Ordinary Account for their housing purchase first

before HDB would grant them the loan for the rest of the price of the flat. The homebuyer can only retain up to $20,000 in the balance of their CPF Ordinary Account. As a result, not many people would need to leverage up to 85% of the purchase price of the flat.

The Covid-19 pandemic has led to the disruption in the supply chain of construction materials and labour in Singapore. This led to the delay in the completion of HDB BTO flats from the usual 3 to 4 years before the pandemic, to the current expected construction period of 4 to 6 years.

Some homebuyers who could not wait for the longer construction period of BTO flats would buy HDB resale flats, resulting in the higher demand and steady price increase of HDB resale flats in 2021.

The latest cooling measures do not solve the disruption in the construction industry.

Outlook

The private residential property sales volume will be subdued in the short term. However, it would gradually recover as the market comes to terms with the cooling measures. Developers will launch more residential projects and buyers will return to the market.

The HDB resale market is expected to remain healthy in terms of transactions and price growth in 2022.

We will help you plan and find a property with financial prudency