Private Housing Outlook

Property Price Trend

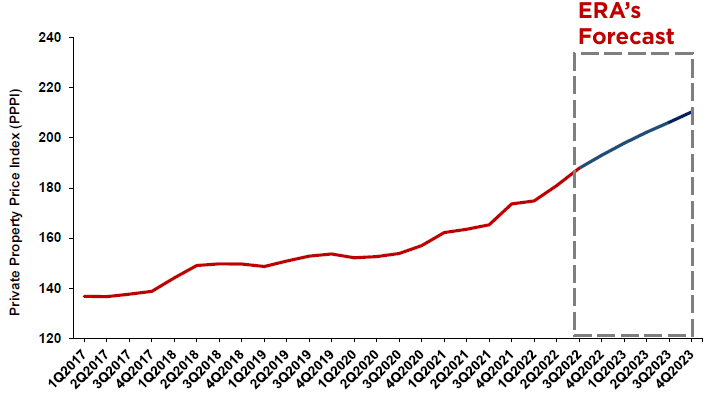

Private residential property prices are expected to continue to grow next year, partly driven by rising development costs which subsequently resulted in higher prices of new residential project that would be launched in 2023.

The rising development costs will dissuade developers from lowering the prices of their new residential launches. As each new project is launched at a higher price than the previously launched projects, some developers may even raise the prices of the unsold units in their residential developments that are already launched in 2021 and 2022.

As a result, he private residential property price index could rise by up to 12% year-on-year (YOY) in 2023.

Figure 1: Private residential price trend

Source: URA, ERA Research & Consultancy

Private Primary Market

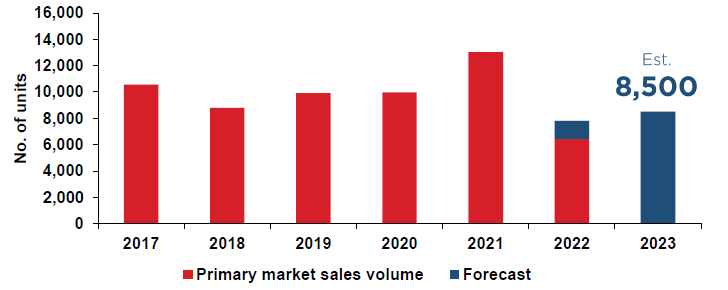

More private residential projects are expected to be launched in 2023 after Lunar New Year. There are an estimated 30 new projects lined up to be launched next year, as compared to the 21 project launches in 2022.

The fast pace of sales in new launches in 2021 and 2022 has left a record low number of unsold residential units in the market. The higher number of projects prepared for launch in 2023 could be well-received by buyers, especially in locations where there are no new launches for a few years.

Due to low supply and rising costs, some developers will test new benchmark prices by launching their new projects at higher prices than nearby projects launched earlier in 2021 and 2022.

Homebuying demand from owner-occupiers is expected to remain stable due to desire to own one’s own home and to avoid rising rentals. However, macroeconomic factors such as higher interest rates could taper investment demand.

Figure 2: Primary market sales volume (Excluding EC)

Source: URA, ERA Research & Consultancy

Private Resale Market

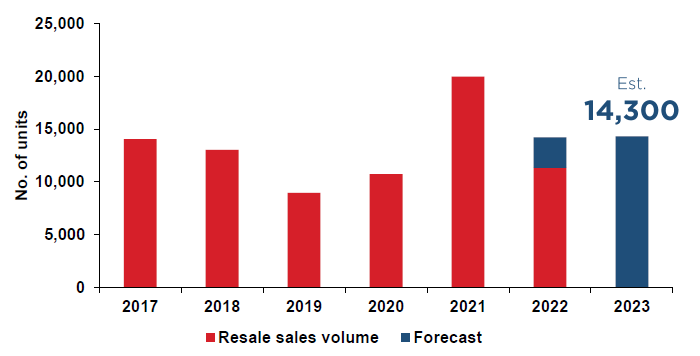

Private resale housing transactions are expected to continue growing at a moderate pace. The likelihood of a resale residential property price correction is low due to the following reasons.

First, the possibility of a severe recession is low in 2023 based on official estimates, Though the Singapore government annouced that the economic growth is forecasted to be slower in 2023, it does not expect an imminent threat of a recession. The silver lining in 2023 could be a strong recovery in our tourism and services related sector, as well as, robust inflows of wealthy investors and investments.

Second, our tight labor market continues to improve with low unemployment rate. Despite the recent layoffs, Ministry of Manpower (MOM) reported that a high proportion of these workers found new jobs within six months.

Third, we see HDB upgraders and those escaping rising rents, such as new permanent residents, to be one of the main demand drivers for resale properties in 2023.

Figure 3: Resale sales volume (Excluding EC)

Source: URA, ERA Research & Consultancy

Private Rental Market

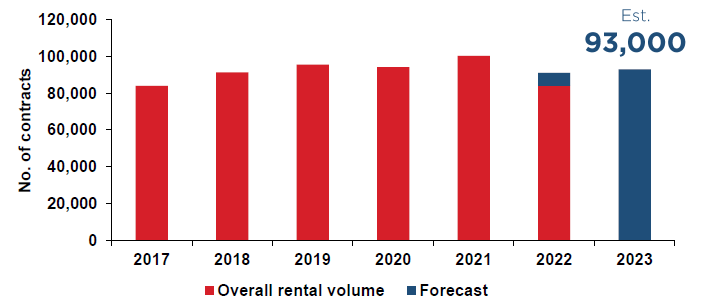

The private residential rental market is not expected to cool down in the first half of 2023. The contributing factors are as follow:

First, the pandemic and supply-chain disruption that cause delays in the construction of new and existing property developments is expected to only gradually ease in 2023.

Second, the re-opening of our borders allow more foreigners to work, study and live here, resulting in steady rise in rental demand.

Third, some local residents are also renting, such as newly-weds whose completion of the BTO flats are delayed and some young people who has to work from home and need more space from their parents.

An estimated 18,200 private housing units are expected to be completed in 2023. Some of these new units could be offered for rent, bringing some relief to tenants and possibly moderate the growth of private residential rents. Private housing rental rates are still expected to rise by more than 12% in 2023, but slower than the 25% to 30% growth in 2022.

The higher number of new units would also contribute to more rental transactions, resulting in 90,000 to 95,000 rental deals in 2023.

Figure 4: Overall private rental volume

Source: URA, ERA Research & Consultancy

HDB Market Update

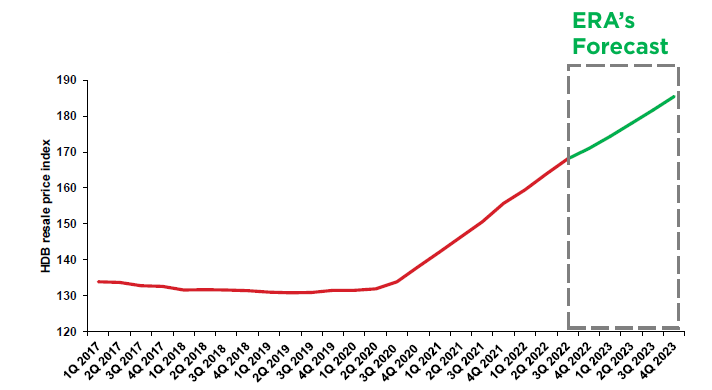

HDB resale price trend

Prices of HDB resale flats will likely continue to rise in 2023 but at a slower pace compared to 2022, partly because of the increase in the supply of new BTO flats and the property cooling measures.

The price growth would still be driven by the supply-demand imbalance where the longer-than-usual completion of BTO flats would cause some homebuyers to acquire HDB resale flats.

As the supply of resale flats is less elastic, the steady demand would drive prices higher in 2023.

However, the stringent cooling measures, such as tighter loan restrictions and the 15-month wait-out period imposed on condo down-graders, may result in fewer million-dollar HDB transactions in the resale market.

Hence, HDB flat price index is projected to moderately expand by up to 10% yoy in 2023

Figure 5: HDB resale price trend

Source: URA, ERA Research & Consultancy

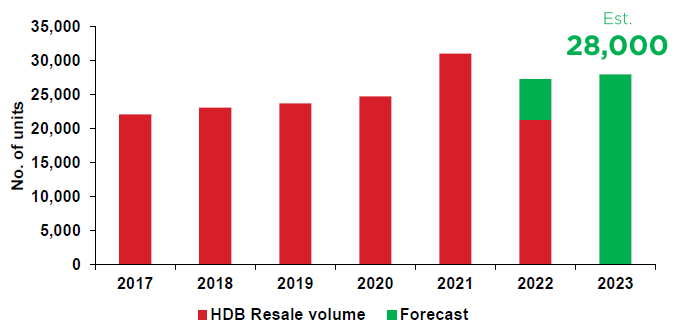

HDB Resale Volume

We expect the HDB resale market to remain very active in 2023 with a healthy level of transactions.

Demand for resale flats will come from buyers who turn away from the piping hot rental market due to skyrocketing rentals.

In addition, as the new batches of BTO flats remains oversubscribed, homebuyers who prefer to move into new homes more urgently will opt for resale flats instead of BTO launches.

A estimated 18,200 private housing units are projected to be completed in 2023, more than double the private housing units completed in 2022. As more condominium units are expected to be completed, HDB upgraders who would take the keys to these new condominiums in 2023 would have to sell their HDB flats to avoid paying ABSD. Hence, more HDB flat will enter the resale market, allowing buyers, such as first-time homebuyers to snag their dream homes.

Figure 6: HDB resale sales volume

Source: URA, ERA Research & Consultancy

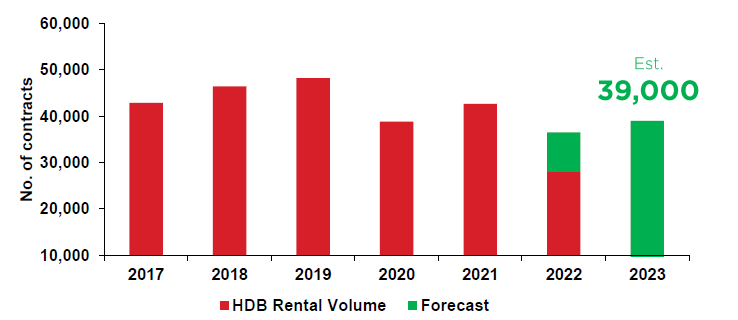

HDB Rental Market

HDB rental rates have jumped significantly this year. Due to a limited supply of rental units available coupled with increasing demand from both locals and foreigners, many landlords took the opportunity to raise their rents.

One possible demand driver in 2023 could be the loosening of China’s Covid-zero policy. This may add more fuel to the rental market as more Chinese expatriates and foreign students come to Singapore.

Furthermore, private down-graders who plan to sell their private homes may also contribute to the leasing demand. As these down-graders who are less than 55 years old, will need to wait 15 months after they sell their private homes, before they could buy the HDB flats, they would need to either live with their relatives or temporarily rent their accommodation.

Lastly, a proportion of rental contracts may be renewed and some tenants may move to new locations within Singapore, adding to the steady rise in HDB rental transactions in 2023.

Figure 7: HDB rental volume

Source: URA, ERA Research & Consultancy

Want to find out more about 2023 property market? Drop me a message and we can have a chat over a cup of coffee.